Have you heard about the latest changes in payroll deductions under the Canada Pension Plan (CPP) for 2023?

In late 2022, the Government of Canada increased CPP employee and employer contributions for 2023. This is part of Canada’s larger CPP enhancement plan to increase CPP max contributions each year starting in 2019.

And that’s not all. Along with a rising CPP cap, 2023 EI rates are also following an upward trend, with contributions seeing gradual increases each year.

What does all this mean for you as an employer, and how will this impact your business’s bottom line? In this article, we’ll go over everything you need to know about CPP and EI rates for 2023 in Canada, including CPP contribution rates, maximums, and exemptions.

What Is the Canada Pension Plan (CPP)?

Let’s start with the basics. If you’re not a Canadian resident, you might wonder, what is CPP? The Canada Pension Plan (CPP) is a mandatory public pension plan in Canada that provides basic financial support to retired, disabled, or deceased workers and their families. It is funded through contributions from both employees and employers as well as self-employed individuals.

The CPP is administered by the federal government and is available to all eligible Canadian residents. Eligibility is determined by an individual's age, work history, and contributions made to the plan. Workers who have contributed to the CPP for at least one year are eligible to receive CPP retirement benefits when they reach the age of 65.

The amount of benefits workers receive is based on their average earnings and the number of years they contributed to the plan.

In addition to retirement benefits, the CPP provides survivor and disability benefits to eligible beneficiaries. Survivor benefits are paid to the surviving spouse or common-law partner of a deceased contributor. In contrast, CPP disability benefit is paid to contributors who are unable to work due to a severe and prolonged disability.

How Much Do Employers Need to Contribute?

Each year, the government sets rates, minimums, and maximums for the CPP. These amounts change yearly and determine how much employers contribute to the CPP.

Under CPP legislation, both the employer and the employee must contribute to the CPP when the employee is working under pensionable employment. Employers are responsible for making CPP contributions for each employee. This amount must also be remitted to the Canada Revenue Agency (CRA).

For CPP contributions, the employer and employee portions are the same.

Calculating CPP Contributions

So, how is CPP calculated? As an employer, you must deduct CPP contributions from your employee's pensionable earnings. CPP payments are typically due monthly.

Employers must contribute an amount equal to the amount deducted from the employees' payment and remit the total of both amounts combined. Employers will continue contributing the required amounts each year under the government's CPP enhancement plan.

Each year, the Government of Canada provides the maximum pensionable earnings, the year's basic exemption amount, and the rate employers should use to calculate the CPP contributions that will be deducted from your employees' payments. For more information, see the government’s CPP calculation table to determine how to manually calculate CPP.

For example, you should deduct a certain amount in CPP contributions from your employee's salary ($240.40) + your share of CPP contributions ($240.40) = the total amount you remit for CPP contributions in that month ($480.80).

Employers must deduct CPP contributions from the employee's pensionable earnings if they meet all of the following criteria:

- The employee is employed in pensionable employment during the year.

- The employee is not disabled under the CPP or the Quebec Pension Plan (QPP).

- The employee is between 18 and 69 years old, even if they are receiving a CPP or QPP retirement pension (unless an employer receives a completed Form CPT30).

For companies in Quebec, employers must deduct Quebec Pension Plan (QPP) contributions instead of CPP contributions. Max QPP contribution rates are typically higher than Max CPP contribution rates. For more information on QPP, see Guide for Employers: Source Deductions and Contributions.

Maximum Pensionable Earnings for 2023

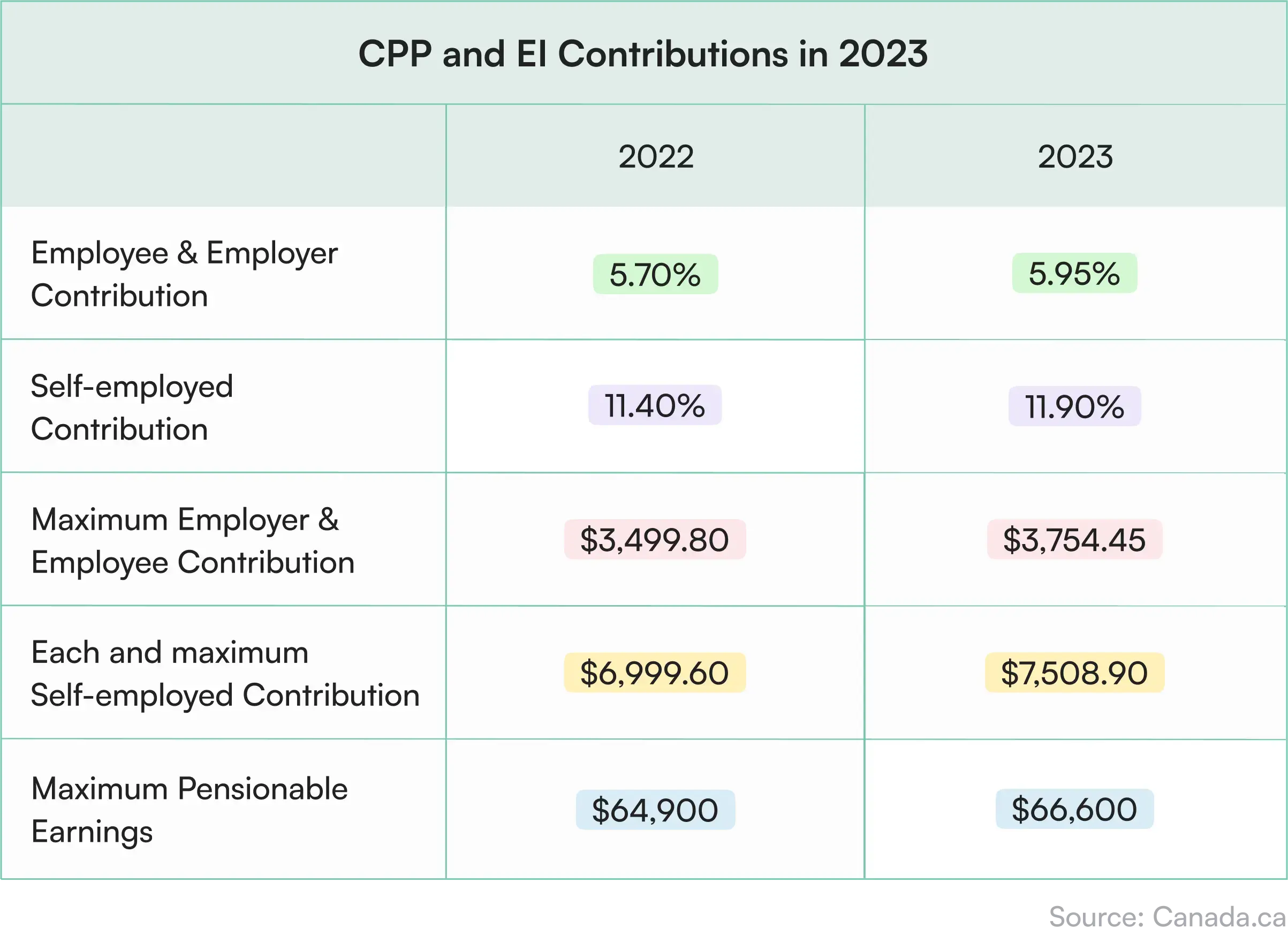

That said, what are the CPP and EI maximums 2023? In 2023, the maximum pensionable earnings for the Canada Pension Plan (CPP) are $66,600, up from the CPP max 2022 of $64,900. This adjustment was determined using a CPP-legislated formula that considered the growth in average weekly wages and salaries across Canada.

Individuals who earn more than $66,600 in 2023 are not required or permitted to make additional contributions to the CPP. Additionally, the basic exemption amount for 2023 will remain at $3,500.

CPP 2023 rates for maximum employer and employee contributions are 5.95%, a rise from 5.70% in 2022. The self-employed contribution rate is 11.90%, up from 11.40% in 2022. This increase in contribution rates reflects the ongoing implementation of the CPP enhancement.

The maximum CPP contribution 2023 allowed by employers and employees is $3,754.45 each, and the maximum self-employed contribution is $7,508.90. The CPP contribution limit for 2022 was $3,499.80 for individuals and $6,999.60 for the self-employed.

What Are Considered CPP Pensionable Earnings?

Pensionable earnings refer to the compensation the employee receives from a pensionable position or job with some exclusions.

Typically, employers are required to deduct CPP contributions from:

- Salary, wages, or other forms of compensation

- Commissions

- Bonuses

- Most taxable benefits

- Honorariums

- Some tips and gratuities

When to Stop Deducting CPP Contributions

As an employer, you stop deducting CPP contributions when your employee's annual earnings reach the maximum pensionable earnings ($66,600 CPP max 2023) or maximum employee contribution for the year ($3,754.45 CPP max 2023).

The concept of annual maximum pensionable earnings applies independently to each job held by an employee with distinct employers (each with a unique business number).

If an employee transitions from one employer to another within the same year, the new employer must deduct CPP contributions, regardless of what the previous employer had already contributed. This is true even if the employee had already reached their maximum contribution threshold with their previous employer.

Regarding retirement, the official retirement age in Canada in 2023 is 65 years old. However, employees can start receiving benefits as early as 60, meaning that some employees might opt to start receiving government retirement benefits around this age.

If you receive a completed Form CPT30 during the year from an employee who is between the ages of 60 and 70, you should stop deducting CPP contributions for that employee.

The Canada Pension Plan (CPP) and CPP Enhancement

What Is CPP Enhancement?

The Canada Pension Plan (CPP) enhancement, implemented on January 1st, 2019, aims to boost retirement income for employed Canadians and their families.

The CPP consists of:

- the base (or original CPP)

- the first additional component, which was phased in between 2019 and 2023

- the second additional component, which will be phased in between 2024 and 2025

Upon maturity, the CPP enhancement is projected to raise the maximum CPP retirement pension by approximately 50%. It will also enhance survivor and disability pensions.

This projected improvement in the CPP aims to decrease the number of Canadian families vulnerable to not saving adequately for retirement, particularly those without access to a workplace pension plan.

How Does It Work?

As of 2019, annual CPP contribution rates began to rise and will continue for the next seven years.

Before January 1st, 2019, employees and employers each contributed 4.95% of the employee's pensionable earnings up to the maximum annual pensionable earnings. This is the base contribution to the CPP.

Between 2019 and 2023, the employee contribution rate gradually increased from 4.95% to 5.95%. This is the initial base contribution (4.95%) and the first additional CPP contribution (1%) that represents the increase to the year’s maximum pensionable earnings (YMPE) or first earnings ceiling.

Starting in 2024, a new tier of maximum pensionable earnings for the year (second earnings ceiling) will be introduced. A second supplementary CPP contribution (CPP2) will be applied to these earnings, starting from the first earnings ceiling up to the second earnings ceiling.

How Will CPP Enhancement Affect Businesses?

The Canadian government is responsible for setting the maximum contribution amount at the beginning of each year based on increases in the average wage in Canada. This number affects the maximum annual contribution that is made on behalf of employers and employees.

As mentioned above, before 2019, the contribution rate stood at 4.95%, with the maximum pensionable earnings and maximum employer contribution rate increasing marginally each year.

However, since the CPP enhancement plan took effect, these rates have begun to increase faster. The CPP increase in 2023 alone has jumped 0.25% from last year’s rate in 2022. Looking at the years 2019 to 2023, Canada’s maximum annual employee and employer contribution has increased by a total of $1,005.55 since the CPP enhancement began. That number is not far from the total increase from 2008 to 2018 ($1089).

Needless to say, these changes may pose some challenges for employers. This rapid increase in rates means employers will need to stay up to date with information released by the Government of Canada regarding yearly contribution rates and amounts, as well as processes that must be followed to comply with the new tier of second supplementary CPP contributions that will be introduced starting in 2024.

It’s worth noting that all employer contributions to the CPP are considered tax deductible. However, this requires global employers to know about Canada's legal and tax systems to avoid any consequences associated with non-compliance or misclassification.

This is where a global Employer of Record (EOR) can help. An EOR is a third-party entity that employs talent for your company. A global EOR takes on your company’s employer-related responsibilities and ensures all contract, insurance, banking, tax, and CPP payroll requirements are met.

You will still manage your global hires' day-to-day responsibilities while your EOR partner manages the in-country logistics. This allows you to compliantly employ and pay hires in Canada and around the world without having to set up costly foreign legal entities in those countries.

_-1.webp)

What Is Employment Insurance (EI)?

Employment Insurance (EI) is a program in Canada that provides temporary financial assistance to eligible individuals who have lost their jobs and are actively seeking employment. It is a federal program that is administered by the Government of Canada.

EI benefits are intended to provide temporary financial assistance to unemployed individuals due to no fault of their own, such as a layoff, plant closure, or illness. To be eligible for EI benefits, individuals must work a certain number of insurable hours and be available and actively seeking employment. As of 2023, individuals need at least 420 hours of insurable employment to qualify.

Those who are eligible can receive weekly EI payments for up to 26 weeks (or longer in certain circumstances). The amount they are eligible to receive is based on their average insurable earnings over the past 52 weeks and is subject to a maximum amount. The EI max 2023 weekly benefit is $650.

In addition to regular EI benefits, special benefits are available for certain situations, such as maternity and parental leave, sickness or injury, compassionate care, and family caregiver benefits. These benefits provide financial assistance to eligible individuals during these challenging times.

According to CPP and EI regulations, both the employer and the employee may have a responsibility to contribute to CPP when the employee is engaged in pensionable employment and to EI when the employee is in insurable employment.

For CPP contributions, the employer and employee portions are the same. However, for EI premiums, the employer portion is generally 1.4 times the employee portion.

Employer EI Contributions in 2023

EI and CPP max 2023 contributions follow an upward trend. In addition to the Canada Pension Plan (CPP) contribution rate sitting at 5.95% in 2023 (up from 5.70% in 2022), EI rates 2023 will also increase.

As of January 1st, 2023, maximum insurable earnings (MIE) will increase from $60,300 to $61,500. Insured workers will pay EI premiums on insured earnings of up to $61,500.

The EI max contribution 2023 rate will be $1.63 per $100 for employees and 2.28% for employers who pay 1.4 times the employee rate. These rates have increased from the 2022 rates of 1.58% and 2.21%, respectively.

This means that in 2023, employers will pay a maximum annual EI premium of $1,403.43 per employee, up from the EI max contribution 2022 rate of $1,333.84. This rate may differ in Quebec.

For employers, this means additional contributions for each employee. If you have multiple employees located in Canada, you’ll be responsible for making correct contributions on behalf of each employee. You must stay up to date with the yearly changes to CPP and EI contribution rates, or else risk non-compliance fines and possible criminal charges.

For businesses based outside of Canada with Canadian employees, this can get very complex very fast. By partnering with a global Employer of Record (EOR), you can avoid the risk of incorrect contributions. Your EOR will handle all payroll-related taxes and government contributions so you can focus on your business and staff.

What Does All This Mean for Employees?

The money that appears in your employee’s bank account will decline as global payroll rates increase (both CPP and EI). According to the Canadian Federation of Independent Business (CFIB), increases in CPP and EI premiums may equate to $305 less in employee’s overall take-home pay in 2023.

On the bright side, the annual limit for a Tax-Free Savings Account (TFSA) has increased to $6,500. An increase like this has not happened since 2019. Employees could make up the difference in their take-home pay by investing in a TFSA or Registered Retirement Savings Plan (RRSP).

Beyond take-home pay, the people who may be the most affected by these hikes are small businesses and those who are self-employed.

Plan Ahead

Overall, CPP and EI are important components of Canada's social safety net. They are designed to help Canadians maintain a basic standard of living in retirement, as well as during periods of disability, unemployment, or following the death of a loved one.

However, if you are an employer who manages an international workforce, partnering with an experienced global Employer of Record like Borderless can prove invaluable to your business. Not only can we help manage yearly contributions to Canada’s ever-changing CPP and EI programs, but we also act as a trusted third party that can help you hire and pay employees in over 170 countries.

Borderless is your number-one resource for Global EOR, Contractor Management Global Payroll. Speak with our team today to get started.