The professional talent in the United States has always been highly desirable for those hiring internationally. Especially for Canadian companies wanting to hire in the United States.

Not only do they offer a highly-diversified and skilled talent pool, but they also share English as their primary language, standardized North America business practices, similar markets, and cultural norms.

And thanks to its close proximity and similar time zones, the United States is one of the easiest countries to hire skilled workers from.

To hire in the United States, however, there are certain things that Canadian companies will need to consider. Aside from compliance with United States federal law, it’s also important to adhere to the different rules and regulations regarding labor in each separate state. These include considerations such as payroll, employee benefits, taxes and more.

In this guide, we’ll cover the details of how a Canadian company can hire skilled workers in the US. We’ll also explore what Canadian companies need to know if partnering with a global Employer of Record (EOR) to oversee the legalities and potential costs of hiring in the United States.

Can a Canadian Company Hire in the United States?

Yes, a Canadian company can hire in the United States. There are no rules or regulations that prohibit Canadian companies from hiring employees in the United States.

However, there are many legalities and local laws that must be taken into consideration to ensure that you are following United States employment laws.

Below are some things to keep in mind when hiring in the United States and a few ways in which a Canadian company might go about employing skilled workers in the US.

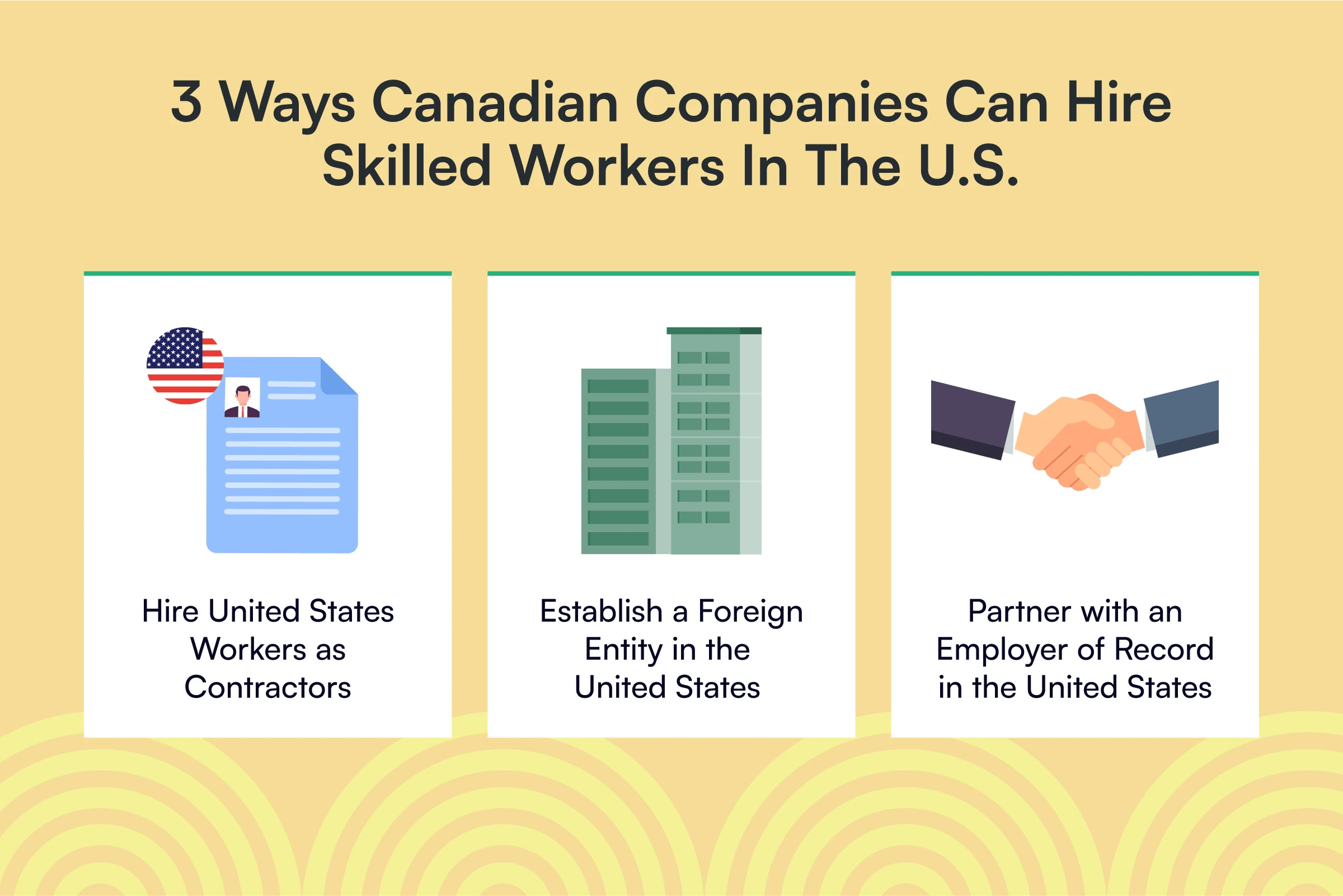

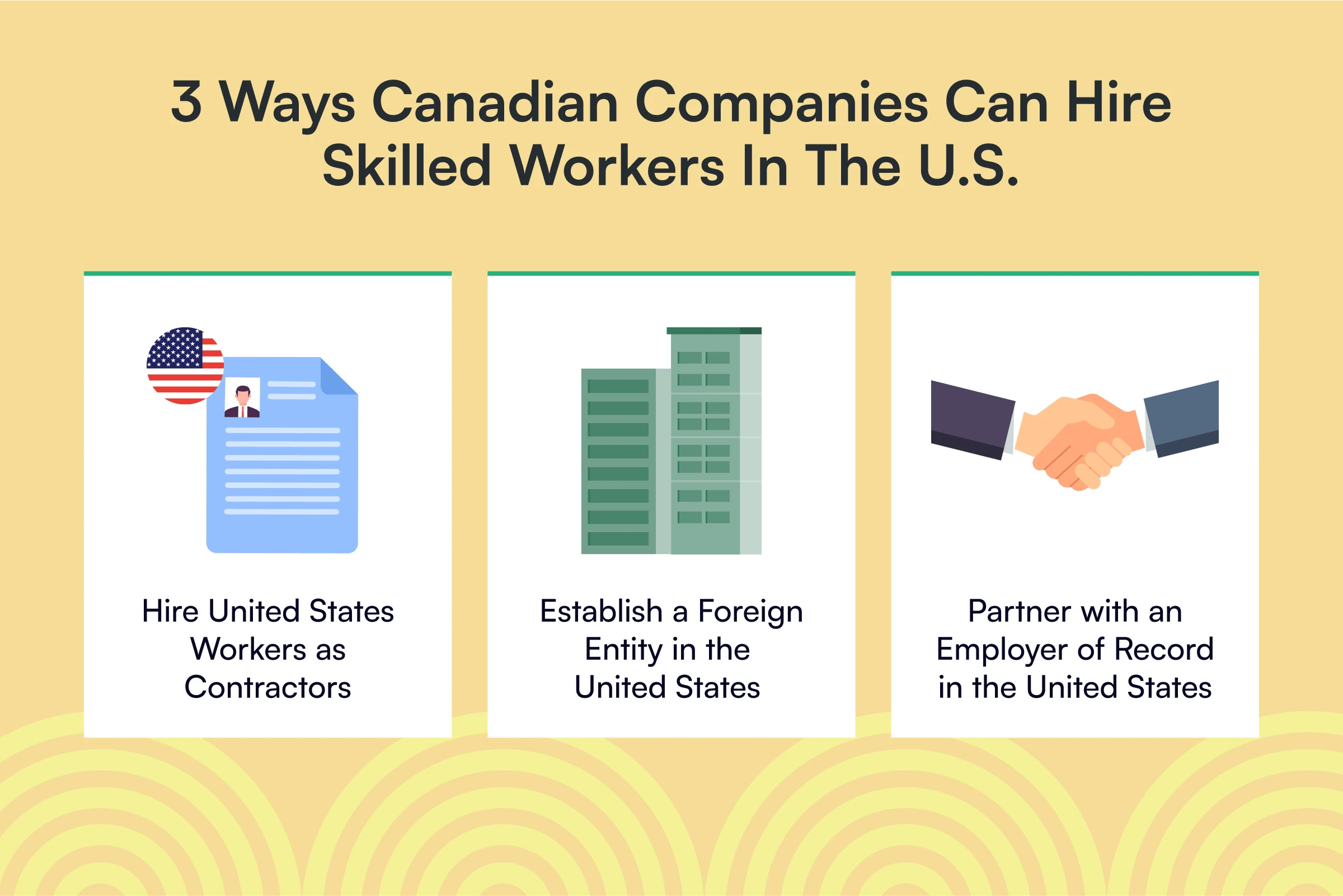

3 Ways Canadian Companies Can Hire Skilled Workers in the US

1. Hire United States Workers as Contractors

Contract staffing in the United States might be the easiest option. But there are still certain things that Canadian companies must take into consideration to ensure that all legal working conditions are met.

Independent contractors in the United States are self-employed individuals who provide their services to the company, while choosing their own working hours and schedules.

As with Canada, a United States-based contractor is treated independently from a company’s internal employees. Independently-hired contractors are not paid a fixed salary or provided with work equipment by the company of hire.

This allows companies more flexibility and is more cost-effective when hiring for specialized services or one-time projects. Independent contractors may also provide their services to a company for extended periods of time.

However, Canadian companies considering hiring independent contractors must be aware of all associated legal risks with misclassifying contractors as full-time employees for which the company may be liable to pay tax violation fines, including up to 3% of the misclassified employee’s wages as well as associated FICA taxes.

Canadian companies might also face fines for federal labor law violations under the United States Fair Labor Standards Act (FLSA).

2. Establish a Foreign Entity in the United States

Another option for Canadian companies to hire skilled workers in the US is to set up a foreign entity. Opening an entity in the United States allows you to create a branch or subsidiary to hire workers directly. Setting up a foreign entity allows Canadian companies complete control when hiring local workers, managing payroll, and establishing a local branch.

Depending on the nature of the business, your company may need to obtain proper permits or licenses from local, state, or federal authorities to operate legally in the US.

Establishing a foreign entity is a good option if your company plans on hiring multiple workers or creating a more established long-term presence. It is, however, a costly and time-consuming process that requires knowledge of the country’s legal, corporate, and payroll laws and regulations.

Consider consulting with local legal professionals or professional institutions if this is the path your company is considering.

3. Partner With an Employer of Record in the United States (EOR US)

The third, and arguably easiest option, is to engage an Employer of Record services (EOR) to hire, pay, and manage your US-based hires. Because the EOR partner is already set up as a legal entity in the United States, they will help ensure that their client company is in alignment with local labor laws and requirements.

An EOR US partner will act as the legal employer for your staff in the US It will offer global payroll solutions for company employees, as well as take care of tax deductions including Federal Income Tax, Social Security Taxes and Medicare tax, and potential additional private health insurance.

Ultimately, an EOR US partner is the easiest option and will help streamline everything from employee onboarding to the payroll process while protecting against any legal mishaps so you can focus on growing and expanding your business - headache-free!

Things to Consider When Hiring in the United States

Although it’s easy enough for Canadian companies to hire in the United States, there are many legalities and government requirements that will affect both the company and the individual employee.

Local Employment Laws and Employment Contracts

US employment laws can vary by state and include things such as:

- Minimum wage (set by US federal law as $7.25 per hour, though it can vary from state to state)

- Overtime pay of one-and-a-half times their hourly rate for any hours over 40 worked by the employee per week

- Standard employee benefits

Additional benefits will also need to be taken into consideration when hiring in the United States.

Additionally, employment contracts should outline job responsibilities, compensation and other terms of employment including at-will employment, which is a US employer's ability to dismiss an employee for any reason, and without warning with or without just cause, as long as the reason is not illegal.

Tax Considerations

Hiring employees in the United States will likely pose tax implications for Canadian companies. Your company will need to understand and comply with US tax laws and regulations, including payroll taxes, social security taxes, medicare taxes and possible 401(k) contribution-related taxes. Payroll processing for your global team can be a real challenge if you're unsure of how to navigate it.

Workplace Regulations

Canadian companies hiring in the United States must be aware of workplace regulations related to safety, discrimination, harassment, and other labor-related matters.

These regulations can vary by state and locality, meaning your company will be responsible for creating a safe working environment, where both the hiring party and employee are fully aware of their rights at all times.

Human Resources Management

Canadian companies, whether hiring an individual as a contractor or establishing a foreign entity, should have a plan in place to manage human resources matters including onboarding, employee training and management, and dealing with any potential employment disputes.

You'll need to ensure that the US skilled workers that you employ have the right paperwork in the state of employment. If you're hiring foreign nationals who reside in the US, ensure that they hold a foreign equivalent degree and labor certification.

Your HR department will need to keep these things in mind and more as you onboard your global team.

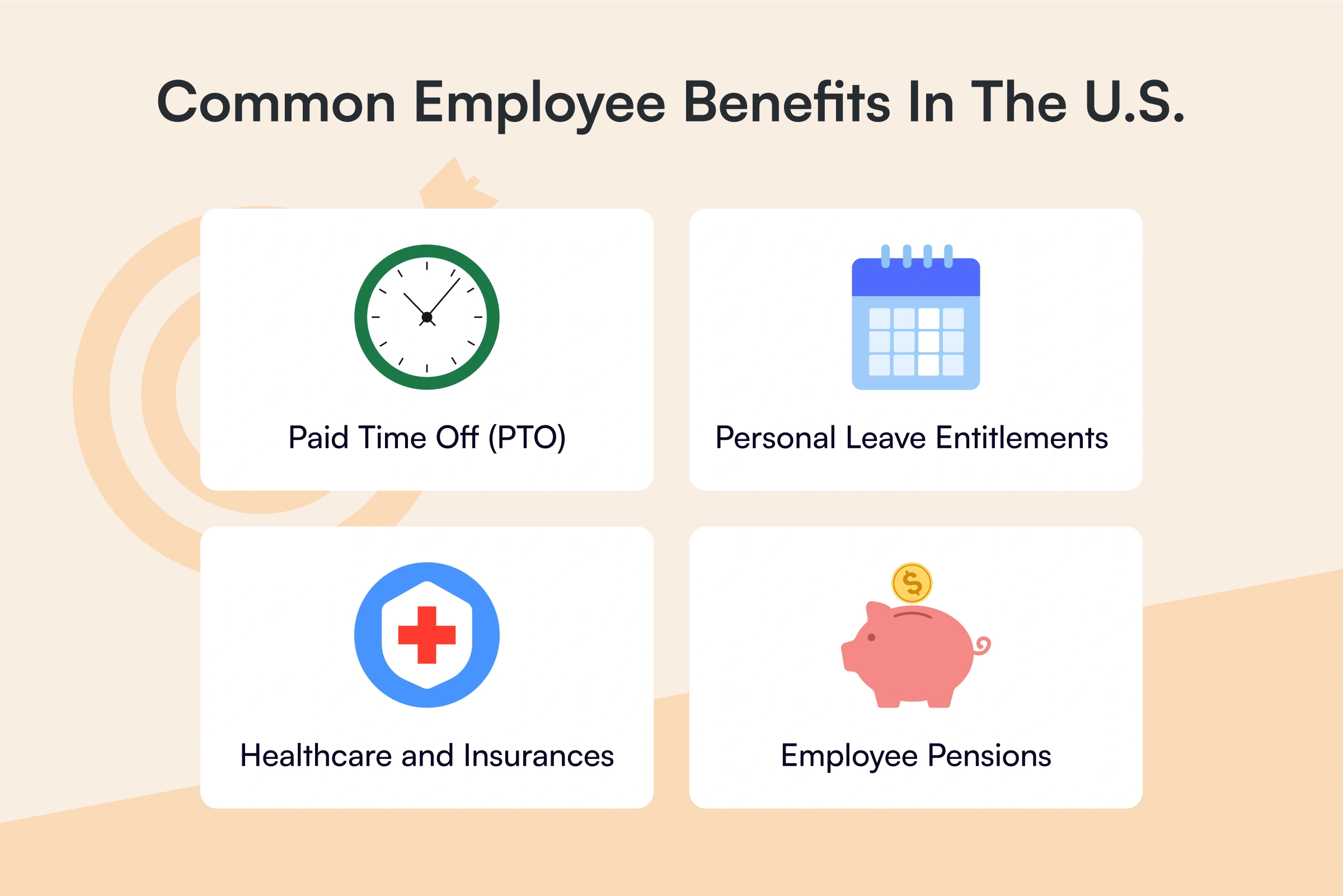

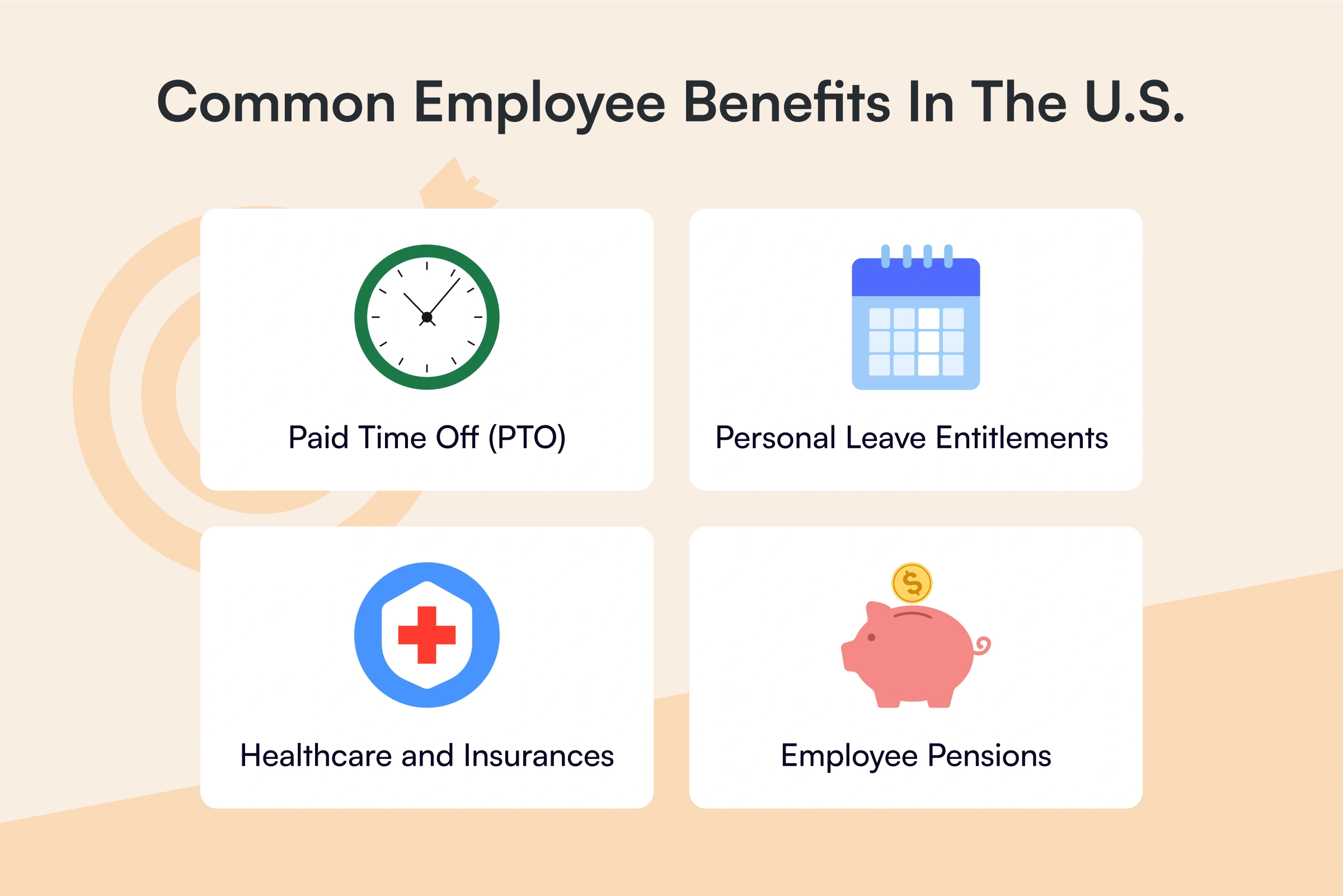

Common Employee Benefits in the US

Your company should also ensure that all US-based employees are given appropriate paid time off and benefits as required by United States law.

Employers must provide legally mandated benefits to all eligible employees, including:

Paid Time Off (PTO)

The average American worker is also entitled, by law, to 11 days of paid vacation per year, as well as eight days of sick leave per year. The United States Federal Government also recognizes the following 10 holidays per-year, as well as an additional Inauguration Day Holiday every fourth year.

- New Year’s Day: January 1

- Martin Luther King’s Birthday: 3rd Monday in January

- Washington’s Birthday: 3rd Monday in February

- Memorial Day: last Monday in May

- Juneteenth National Independence Day: June 19

- Independence Day: July 4

- Labor Day: 1st Monday in September

- Columbus Day: 2nd Monday in October

- Veterans’ Day: November 11

- Thanksgiving Day: 4th Thursday in November

- Christmas Day: December 25

Personal Leave Entitlements

Holidays and Annual Statutory Leave

Although there are several national holidays that are acknowledged by the United States government, there is no federal law that requires companies to provide employees with time off.

However, it is common for companies to provide employees with paid time off for national and local holidays.

Annual vacation time might range from one week per year, to three weeks or more for long-time employees. Employees represented by a labor union might also receive more days off depending on the specific terms of their labor agreement.

Maternity and Parental Leave

The Family and Medical Leave Act (FMLA) requires companies that employ fifty or more employees to provide twelve weeks of unpaid leave for the birth of a child. Some state laws also provide maternity leave for employees who are not covered under the FMLA.

Additionally, though they are not required to, many states will provide employees with partial pay during parental leave.

Sick Leave

United States employees may be entitled to unpaid sick leave under the FMLA, which allows employees to take up to twelve weeks unpaid medical leave for health conditions that prevent the employee from competently carrying out their job. Colds, headaches, and routine medical care are generally not covered.

Disability Leave

Employees with disabilities may be entitled to unpaid leave under the FMLA and Americans with Disabilities Act (ADA). While the ADA is not required to provide for employees on disability leave, it does require companies to make accommodations for employees with disabilities, which could include employee leave, so long it is not unreasonable for the company to do so.

Social Security and Medicare Contributions

United States law provides retirement benefits and health insurance under federal Social Security and Medicare programs. According to the United States Internal Revenue Service (IRS), all companies are required to contribute 6.2% of every employee’s salary to Social Security, as well as 1.45% to Medicare. Contributions equal to these amounts will be taken from each employee’s wages as an employee contribution.

These contributions are meant to provide benefits for retirees, disabled workers, children of deceased workers, as well as hospital insurance benefits.

Healthcare and Insurances

As outlined by the Patient Protection and Affordable Care Act, certain companies who do not offer affordable health insurance options to full-time employees may be faced with financial penalties. Employers will be subject to a penalty of $2,570 USD per-employee if the company does not offer health insurance to at least 95% of their full-time employees.

Employee Pensions

Although it is not legally required for companies to provide employee pensions or retirement benefits, many American companies do provide some retirement benefits, most commonly in the form of a retirement savings plan, referred to by most as a 401(k) plan under the Internal Revenues Code.

Depending on the size of the company, employees are also typically given additional benefits. These include health insurance and paid parental leave, as mentioned above, as well as disability insurance, life insurance, dental insurance, vision insurance, financial assistance with commuting and travel, and various wellness benefits.

Common Risks for Canadian Companies Hiring in the United States

As mentioned before, there are many things to consider when hiring in the United States. In this section, we will briefly discuss a couple of the most common risks for Canadian companies to consider when hiring skilled workers in the US.

Misclassification of Contractors as Full-time Employees and vice versa

When hiring a skilled US worker for a contract position or for full-time work, you should ensure that they are classified correctly. The IRS acknowledges this as a common issue amongst international companies and advises the importance of proper classification, as well as the corresponding taxes that need to be reported in both Canada and in the United States.

To avoid fines and legal complications, consider working with a legal expert, such as an employer of record (EOR), who can help your company avoid misclassification through proper contracts, accurate reporting, and accurate payroll deductions.

Making Incorrect Payroll Contributions and Deductions

Canadian companies must consider contributions such as social security and medicare contributions, paid time off, healthcare and other insurance among others.

Companies are required to calculate, deduct, and contribute the correct amount to US authorities. Lack of deductions or incorrectness in deductions and contributions could result in legal complications or fines for the employer.

Potential Visa Requirements

Canadian companies wanting to hire employees in the US need to ensure that the potential employee has appropriate United States work authorization. This might involve obtaining a work visa if the person of hire does not have existing legal authorization to work and receive payment in the United States.

Such visas might include H-1B visa (for specialty occupation workers), L-1 visa (for intra-company transfers), or other relevant visas based on the individual's specific circumstances.

As an established EOR with legal entities in 170+ countries, Borderless AI is highly knowledgeable and experienced in assisting Canadian employers navigate hiring in the US landscape. Book a demo today to see how Borderless AI can help you hire quickly and efficiently.

Disclaimer

Borderless does not provide legal services or legal advice to anyone. This includes customers, contractors, employees, partners, and the general public. We are not lawyers or paralegals. Please read our full disclaimer here.

Ready to hire anywhere in minutes?